What Do You Want Retirement To Look Like?

Typical Retirement Planning & Advice

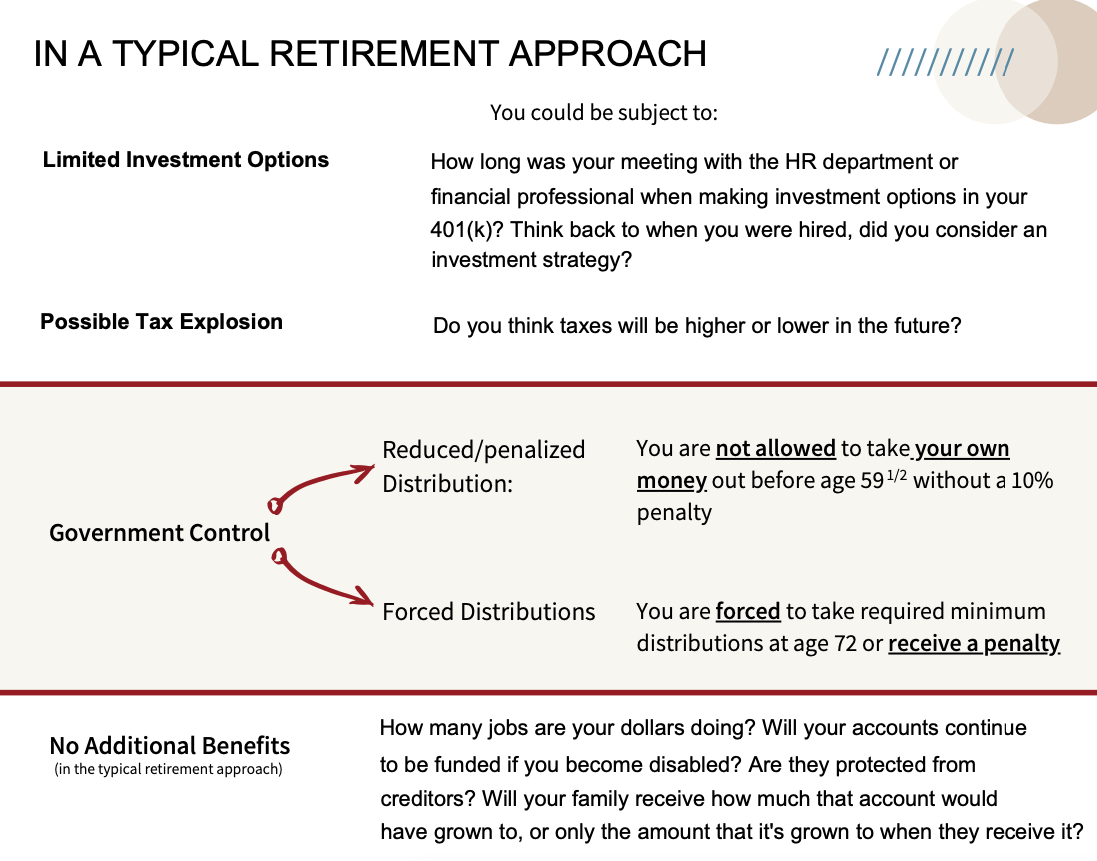

- Set a spending budget

- Move to a cheaper state

- Prepare to live on less income once you retire

- Only live off of your portfolio interest

- Do not cut into your principal

- Take your social security now

- Wait to take social security & get a higher payout

- Buy annuities; they have guarantees

- Get rid of your term life insurance, “self insure” with your assets

How Do You Know What’s Right?

What if your advisors do not agree?

Who do you trust?

Who do you ultimately listen to?

How Are Financial Decisions Made?

- One at a time

- At different times

- With different people

- In different economic environments

We all have a junk drawer at home. Full of all the advice we didn’t read, brochures we never opened and decisions we never made.

What’s Your Strategy?

If you don’t set a strategy towards reaching your Wish List, you will be working to help someone else accomplish their Wish List.

Or like most of the people, you will be overwhelmed by all the “common retirement advice” which will point you to a retirement plan that’s a cookie cutter approach.

Common Risks That Can Threaten Retirement Plans

- Not Enough Savings

- Market Volatility

- Inflation

- Tax Law & Interest Rate Changes

- Unexpected Expenses

- Risk of Outliving Your Money

- Health Issues/ Long Term Care

- Lawsuits/ Legal Issues

When you follow typical financial advice, you contribute to the goals of:

1. Financial Institutions

2. Corporations

3. Government

These are ‘The BIG 3’ that erode your wealth faster than any rate of return can grow it.

So How Do Banks Make Money?

Banks do not use compounding interest to make more money, they use Velocity of Money.

Velocity of Money »»

The Velocity of Money means your dollars are doing as many jobs for you as possible.

When using the Velocity of Money approach, as opposed to the typical accumulation/compounding approach, your dollars can get you a rate of return, use for additional rates of return, insurance benefits, recapture other money lost, and builds a multiplier effect of more money supply and more benefits. Money that is constantly in motion and moving faster than the eroding factors allows you to build and protect your wealth better.

Wealth eroding factors have a larger negative impact if your money is stationary, doing only one job, or providing only one benefit. The strategy that banks use is not based on compound interest over a 30-year period. They use your money and get it moving as fast as possible, because they know today’s dollars are much more valuable than tomorrow’s dollars.

So, Why Not Use The Same Strategy?

In what Forms Do You Give Banks Money?

A few ways you were told you would make the most out of your money:

- Payroll deducted qualified retirement plans

- Dollar cost averaging

- Term or group life insurance

- Roth IRA or 529 Plans

- Compound interest

- Low deductibles on insurance

- Mortgages of less than 30 years or pre-paying mortgages

Institutions tell you to chase a rate of return, but that alone will not make you successful. The key is to prevent wealth eroding factors.

MONEY HAS NO VALUE UNTIL YOU ARE IN A POSITION TO ENJOY IT WITH THOSE YOU CARE ABOUT MOST.

GIVE YOURSELF THE ABILITY AND PERMISSION TO ACCOMPLISH THIS.

If you’re wondering how we can help you, and would like to have a conversation click the button below to get started.

Or you can email me at info@ryleysmith.net

214 Overlook Circle

Suite 120

Brentwood, TN 37027

Ryley Smith Wealth Strategies is in close proximity to Nashville Tennessee's surrounding cities that include: Murfreesboro, Mt. Juliet, Spring Hill, Brentwood, Oak Hill, Forest Hills, Franklin, Nolensville, & Berry Hill. RS Wealth Strategies Services are not limited to Tennessee residents only.

Recent Comments